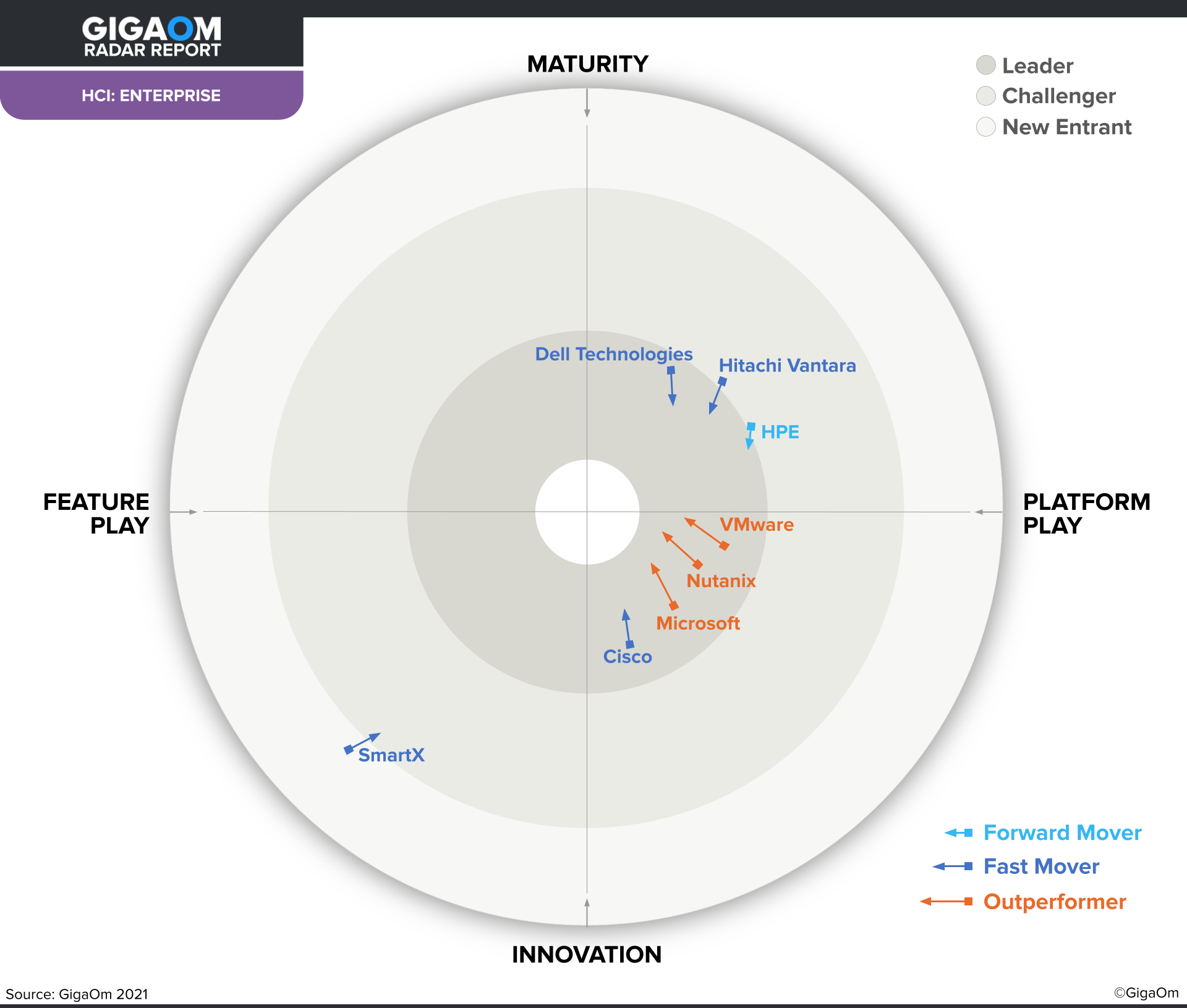

GigaOm, a leading analyst firm, has released the latest GigaOm Radar for Hyperconverged Infrastructures: Enterprise Deployments report, covering 8 different global vendors, in which SmartX is the only China-based vendor, named a “Fast Mover” with focus on feature and innovation.

GigaOm’s radar screen is another industry landscape representation besides Gartner’s Magic Quadrant, Forrester’s Wave, and IDC’s Marketscape, evaluating vendors on innovation, maturity, vision, the capacity of execution, etc. instead of considering market share as a primary element. The report analyzes the leading HCI vendors across 11 key criteria and evaluation metrics, presenting a comprehensive view of enterprise HCI. VMware, Nutanix, Microsoft, Cisco, Dell, etc. are also evaluated in this report. SmartX is a new entrant to the radar, with a strong foothold in the innovation quadrant already.

With its strengths in “high performance virtualization with high availability”, providing ultra-low latency solutions with scalability and flexibility, SmartX has proved its solutions stable and reliable in “the most critical virtualized workloads in financial institutions”, thus “its platform can handle most business use cases.” SmartX’s HCI solution has gained trust from the most demanding financial industry, with a customer repurchase rate up to 77%. SmartX also stands out for its “focus on efficient use of resources and system reliability”, which provides a suitable choice for more value-sensitive and cost-conscious customers.

In addition, SmartX is “expanding its product set from basic HCI to a value added platform,” “to enable and leverage Kubernetes as an application platform.” This includes IOMesh, “a cloud native storage that runs on Kubernetes and provides persistent volumes to other Kubernetes pods”, and Everoute, “a SDN to replace the current VLAN based networking with micro-segmentation architecture that will help Kubernetes and microservices-based applications in particular.” In the meantime, with its fast-moving pace on product/solution iteration, SmartX is continuously expanding in adjacent countries such as Korea and Japan, as well as in Southeast Asia, Middle East and Europe.

Below is GigaOM’s full analysis on SmartX enterprise HCI, click here to download the full report.

SmartX

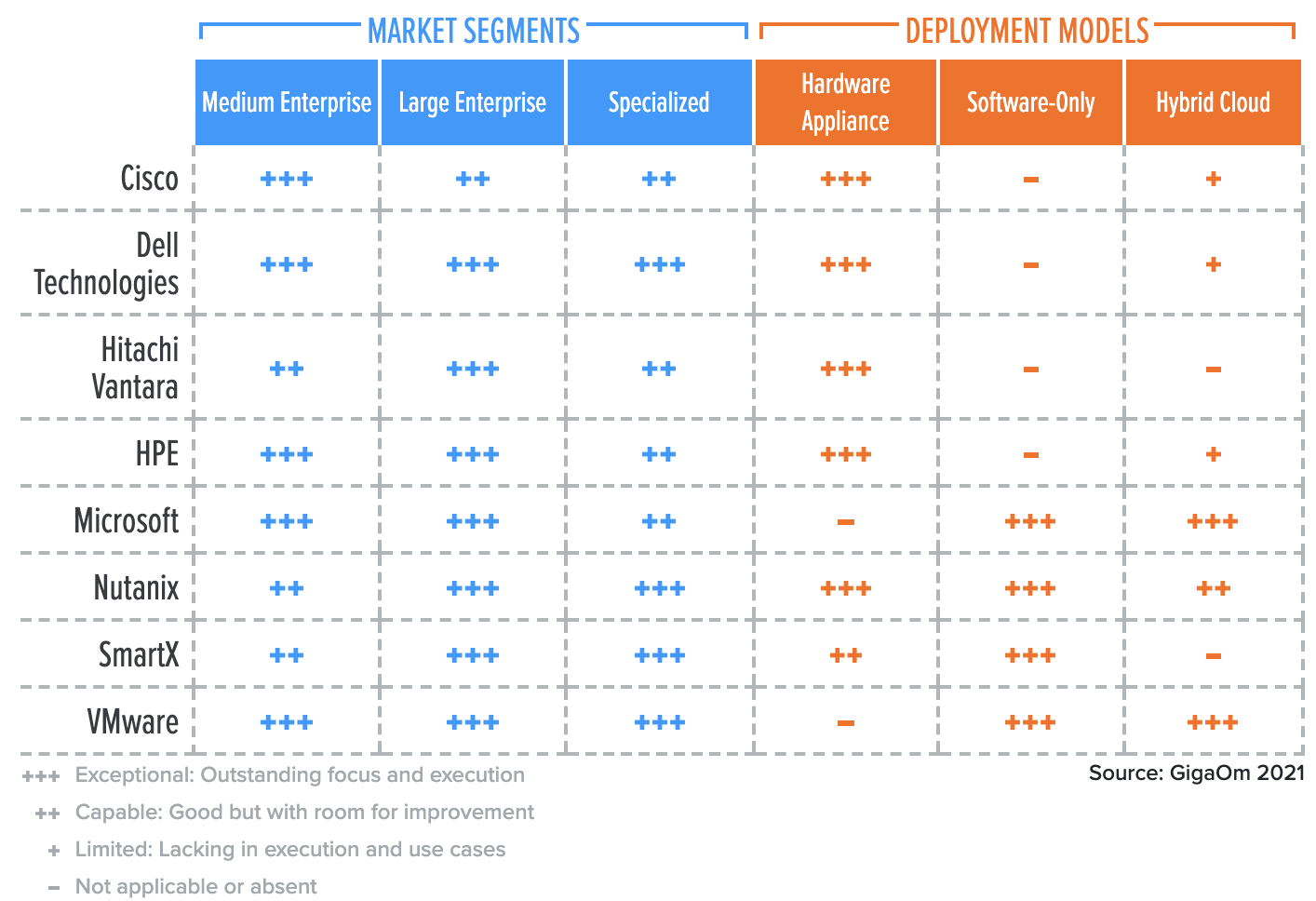

SmartX is a Chinese HCI vendor targeting the most critical virtualized workloads in financial institutions as proof that its platform can handle most business use cases. SMTX OS is the HCI platform from SmartX and can scale from a three-node minimum cluster out to a maximum of 255 nodes in a cluster. The cluster presents storage as iSCSI and NVMe over Fabrics (NVMe-oF) devices, and it can use Intel Optane PMEM to deliver superior storage performance. SMTX OS supports vSphere as a hypervisor, along with Citrix XenServer for some VDI use cases. SmartX also has a KVM-based solution called ELF, removing the need for third-party hypervisor licensing and support. SMTX OS has a strong set of availability options, with synchronous metro-cluster for high availability and asynchronous snapshot replication for disaster recovery. Snapshots can be scheduled and retained locally for data protection.

SmartX offers both a software-only deployment and a physical appliance in its Halo product. Halo includes Intel Optane PMem for storage performance. Once deployed, SmartX software can be updated using a one-click automated mechanism. Multiple clusters across multiple datacenters (including edge locations) can be managed on-premises together using Cloud-Tower, with resource visibility and management across hundreds of clusters.

SmartX appears to be expanding its product set from basic HCI to a value-added platform. Much of this development is meant to enable and leverage Kubernetes as an application platform. One new feature is IOMesh, a cloud-native distributed storage that runs on Kubernetes and provides persistent volumes to other Kubernetes pods. SMTX OS also can deliver block storage to pods through a CSI plugin. The KVM-based ELF hypervisor is the base that enables in-house feature development, which would be more difficult with a third-party hypervisor. SmartX is building an SDN called Everoute to replace the current VLAN-based networking with micro-segmentation architecture that will help Kubernetes and microservices based applications in particular.

The Chinese FinSec industry is very value sensitive and cost-conscious, so having them as an initial target customer has driven SmartX’s focus on efficient use of resources and system reliability. Expansion into adjacent countries has provided a larger market of value conscious businesses.

Strengths: High performance virtualization with high availability.

Challenges: Extending from basic HCI to a platform for Kubernetes and cloud-native applications.